Discover, Collaborate, Transact

Specialized Products Need Specialized Tools

Next generation products, pricing eligibility platform

Simplified accuracy for easy product discovery for your LO’s and Brokers

Technology and integrated collaboration replace rate sheets and manual review

Get a competitive advantage and differentiate yourself from other lenders

The LoanNEX Platform delivers:

Smart Tools for Specialized Needs

- Robust PPE designed for the Expanded Market

- Dynamic ratio calculations for refined eligibility

- Tools to navigate soft guidelines

- Private label for customized experience

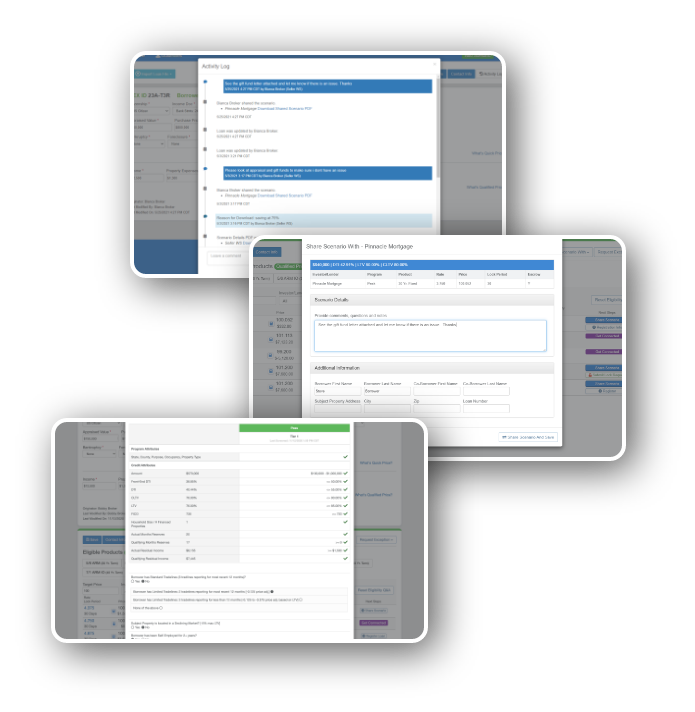

- Brokers can collaborate directly with their Account Executive

- From Scenario testing to Registration and Lock

Market Trends and Insights

- Market Insight

- Access market insights and trends

- Monitor broker needs and market demand

- Market Engagement

- Connect your Account Executive’s and Brokers in a Collaborative Platform

- We match brokers to their assigned Account Executive for enhanced engagement

- Monitor broker needs and market demand

- Brokers can collaborate directly with their AE

- Accessible

- Add a customized Quick Quote tool to your website

- Marketplace Access extend visibility of your products

TURN UP THE VOLUME

Expanded Product Discoverability

Expanded Product Discoverability

Make it easy for Loan Officers to navigate your programs

Connect with your Lenders/Brokers in an interactive pricing and decisioning platform

Collaborate together to help originators navigate complexities quickly and easily

Tools are available in a marketplace or portal environment

Spend your time engaging with your counterparties on real scenarios vs teaching loan-officers about programs and products

Reduce back and forth emails with Account Executive communication

LoanNEX has sophisticated pricing and eligibility tools that support all products, enable collaboration between Lender and Investor, streamline discovery, decisioning, and transacting all from a single platform.

Smart Tools For An Expanded Mortgage Market

1.

Talk to an Expert

A loanNEX expert will set up an enterprise account and program that fits your organization and goals

2.

Submit Content

Submit your rate sheets and guidelines to be built into the LoanNEX platform

3.

Empower Your Team

Arm your Account Executives with a collaboration platform to work in a team capacity with your TPO Lenders – build loyalty while building volume

4.

Grow Your Volume

Enter the loan closing stage of process with more confidence knowing you have the right TPO Leaders to grow your business

I can go on for hours about how great LoanNEX is. It’s a very dynamic and smooth interface for the originator. It basically walks you through the data entry process by asking questions that eliminate the need for future inputs. And the turn times and response time are phenomenal, too.

Robert Trahan

LoanNEX is the best in class for non-qualified mortgages. Legacy engines are good, but LoanNEX is a NonQM-centric engine that is intuitive. The necessary attributes are embedded in the system to filter with a greater degree of accuracy to determine what loans will actually fit and which loans don’t. fit.

David Adamo

Luxury Mortgage Corp.