Specialized Products Need Specialized Tools

LoanNEX is the next generation PPE with tools designed to support expanded products

The goal: Give Originators a path to Yes, and Grow YOUR Volume

The LoanNEX Qualifier is a the most sophisticated and dynamic PPE available

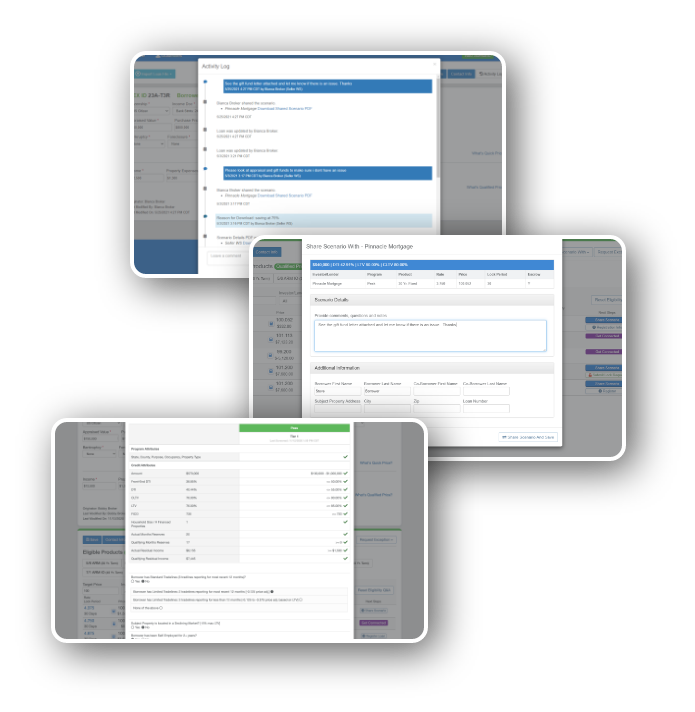

The built-in collaboration tools simplify discovery and decisioning

Increase LO awareness of your products and programs in LoanNEX Marketplace

The LoanNEX Platform delivers:

Smart Tools for Specialized Needs

- Robust PPE for all products

- Dynamic input for relevant results

- Available at POS on a margin adjusted basis for LO’s

- Interactive and Collaborative Experience

- Powerful Decisioning Tools

- Credit guidelines

- Dynamic eligibility and pricing adjustments based on soft guideline considerations

- One-to-One collaboration available between seller and investor

- Loan Submittal and Transaction Tools

- Pre-qual and registration loan submission

- Exception management

- Full Lock management services

- Customizable submittal forms

- Lock services

Market Trends and Insights

- Access Market Insights

- Market trends by attributes

- Product and program demand trends

Pricing trends

- Gain Insight into Counterparty Engagement

- Benchmark counterparty activity

- Gain insight unserved market demand

- Give your AE’s insight into their client engagement

Market Engagement

- Customized Scenario Test Tools available to add to your website

- Connect with your originators in the LoanNEX marketplace

- Increase your product awareness and discoverability – if they can’t see it, you can’t sell it

- Marketplace distribution

- Joint Marketing

- Joint Webinars

TURN UP THE VOLUME

Work Smarter Together

Work Smarter Together

Make it easy for Loan Officers to navigate your programs

Connect with your Lenders/Brokers in an interactive pricing and decisioning platform

Collaborate together to help originators navigate complexities quickly and easily

Tools are available in a marketplace or portal environment

Spend your time engaging with your counterparties on real scenarios vs teaching loan-officers about programs and products

Grow Your Loan Volume and Your Profitability!

1.

Talk to an Expert

A LoanNEX expert will set up an enterprise account and program that fits your organization and goals.

2.

Submit Content

Submit your rate sheets and guidelines to be built into the LoanNEX platform.

3.

Empower Your Team

Arm your Account Executives with a collaboration platform to work in a team capacity with your TPO Lenders – build loyalty while building volume.

4.

Grow Your Volume

Enter the loan closing stage of the process with more confidence knowing you have the right TPO Lenders to grow your business.

I can go on for hours about how great LoanNEX is. It’s a very dynamic and smooth interface for the originator. It basically walks you through the data entry process by asking questions that eliminate the need for future inputs. And the turn times and response time are phenomenal, too.

Robert Trahan

Sprout Mortgage

LoanNEX is the best in class for non-qualified mortgages. Legacy engines are good, but LoanNEX is a NonQM-centric engine that is intuitive. The necessary attributes are embedded in the system to filter with a greater degree of accuracy to determine what loans will actually fit and which loans don’t. fit.

David Adamo

Luxury Mortgage Corp.