Easily Search Viable Options

Access all available Jumbo and NonQM products in one centralized location

Tap Into Eligibility Assistance

Early decisioning with accurate eligibility through our unique program-specific Q&A to navigate soft guidelines by Lender

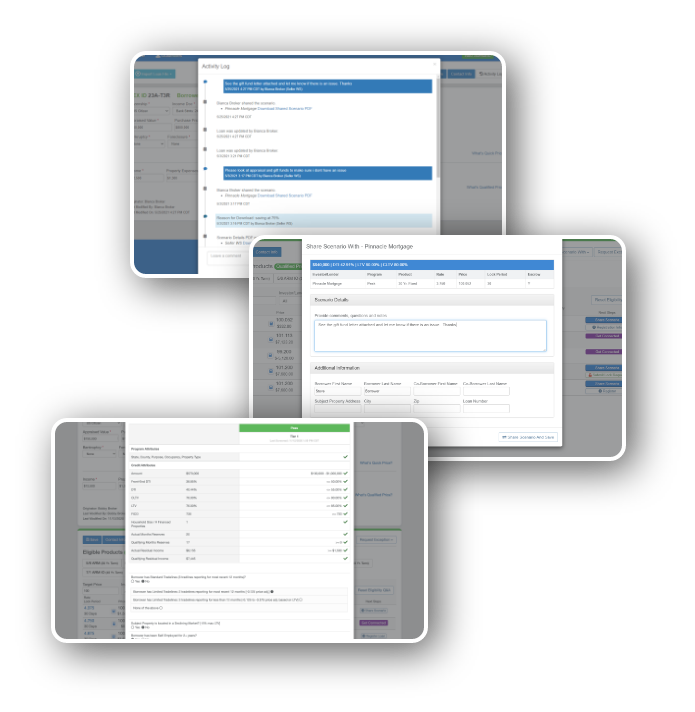

Streamline Counterparty Collaboration

Work directly with your Lender AE for quick access to answers when you need them

Intuitively Generate Accurate Results

Ensure greater accuracy with results that are dynamically produced based on expanded set of data inputs

Get Started with Broker Marketplace

Choose a plan, create an account, and begin pricing

Individual

$40

1 Seat

LoanNEX Qualifier

PPE with Aggregated Market Results

Pipeline Management

Access Saved Scenarios

“Get Connected”

to new Lenders

Lender Collaboration

With Notifications and PDFs sent to AE

Loan Submittal Instructions

Lender specific links and submittal instructions

Enterprise

Starter

$175

5 Seats

LoanNEX Qualifier

PPE with Aggregated Market Results

Pipeline Management

Access Saved Scenarios

“Get Connected”

to new Lenders

Lender Collaboration

With Notifications and PDFs sent to AE

Loan Submittal Instructions

Lender specific links and submittal instructions

Enterprise

Premium

$450

15 Seats

LoanNEX Qualifier

PPE with Aggregated Market Results

Pipeline Management

Access Saved Scenarios

“Get Connected”

to new Lenders

Lender Collaboration

With Notifications and PDFs sent to AE

Loan Submittal Instructions

Lender specific links and submittal instructions

Exchange Access

Registration/Lock submission (if offered by Lender)

Advanced Administrative Settings

• Management/Visibility

• User Management

• Margin Management

• Notification Groups

Enterprise

Unlimited

Unlimited

Seats

LoanNEX Qualifier

PPE with Aggregated Market Results

Pipeline Management

Access Saved Scenarios

“Get Connected”

to new Lenders

Lender Collaboration

With Notifications and PDFs sent to AE

Loan Submittal Instructions

Lender specific links and submittal instructions

Exchange Access

Registration/Lock submission (if offered by Lender)

Advanced Administrative Settings

• Management/Visibility

• User Management

• Margin Management

• Notification Groups

Broker Marketplace is the only interactive platform where you can shop, engage, and transact.

LoanNEX Qualifier – A robust eligibility, pricing, and decisioning engine with direct access to Lenders.

Pipeline Management – Access your previous search loans, saved loans, and active loan scenarios. Collaborate directly with your assigned AEs to get the information that you need.

“Get Connected” – Connect with approved Lenders and start new relationships/approval process with Lenders already in the Marketplace.

Lender Collaboration –Notifications and PDFs are sent directly to AEs. Share prospective loans, trailing documents, and questions to receive consultation from Lenders, AEs, and scenario desks.

Loan Submittal Instructions – With Lender specific links and instructions you can register loans directly to a Lenders pipeline.

Exchange Access – Register and lock loans with approved Lenders all on the same platform (if offered by the Lender).

Advanced Administrative Settings – Customize the visibility of the NEX App data selections and input tooltips. Define access to Lender’s programs, pricing, margins, and Lender Paid Compensation (LPC) on a per user bases. Control access and setup alters to keep your team up to date on pipeline activity.

Discover, Collaborate, Transact

LoanNEX is the next-generation engine for products, pricing, and eligibility in the residential mortgage marketplace. LoanNEX makes discovery and decisions easy for all borrower types – including the more challenging non-QM market. We exclusively offer the only interactive marketplace where you can shop, engage, and transact all on the same platform. You now have the power at your fingertips to streamline your process and make success easier to find.

LoanNEX has combined a robust PPE with B2B collaboration, engagement tools, and accurate market insights to create better access, provide relevant answers, and enable everyone to work smarter together.

Organizations Who Found Success Using LoanNEX

I can go on for hours about how great LoanNEX is. It’s a very dynamic and smooth interface for the originator. It basically walks you through the data entry process by asking questions that eliminate the need for future inputs. And the turn times and response time are phenomenal, too.

Robert Trahan

Sprout Mortgage

LoanNEX is the best in class for non-qualified mortgages. Legacy engines are good, but LoanNEX is a NonQM-centric engine that is intuitive. The necessary attributes are embedded in the system to filter with a greater degree of accuracy to determine what loans will actually fit and which loans don’t. fit.

David Adamo

Luxury Mortgage Corp.

The LoanNEX Broker Marketplace delivers:

Smart Tools to Serve an Expanding Market

- Specialized PPE to access and navigate expanded options

- Aggregated and qualified options

- Supports over 100 unique attributes for greater accuracy and clarity

- Guidelines at your fingertips

- Guideline Q&A customized by program to identify criteria that may impact pricing or eligibility early in the process

- Interactive and Collaborative Experience

- Collaborate directly with your Lender for streamlined scenario clarifications

- Collaborate with several Lenders at once eliminating off-line communication

- Get relevant answers on the full picture of your borrower

- Tools to find answers faster with less errors

Market Trends and Insights

- Stay on top of non-agency market trends

- Monitor your teams engagement with non-agency solutions

- Monitor which Lenders have solutions that fit your borrowers needs

Keep up with the ever-changing market as products and options continue to change quickly