Discover, Collaborate, Transact

Specialized Products Need Specialized Tools

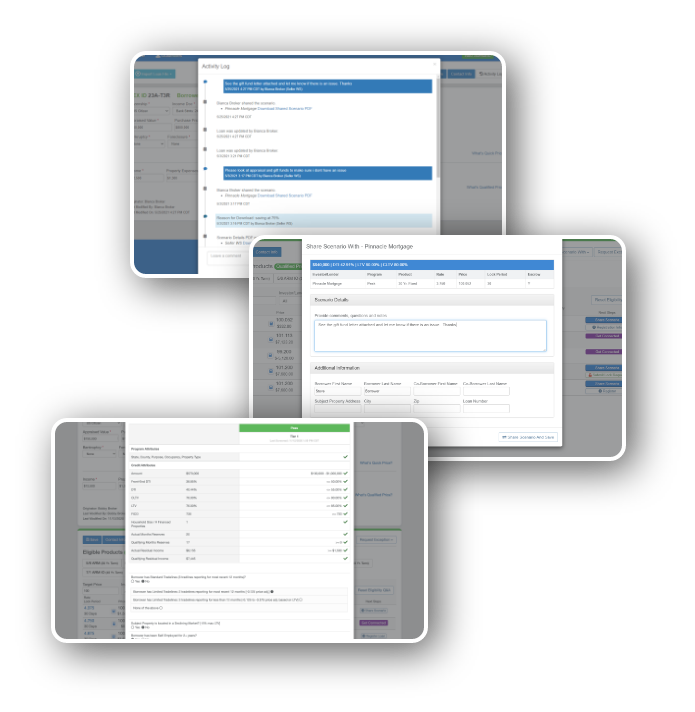

Next generation product and pricing eligibility platform

Simplified accuracy for easy product discovery for your borrowers

Technology and integrated collaboration replace rate sheets and manual review

Get a competitive advantage and differentiate yourself from other originators

The LoanNEX Platform delivers:

Smart Tools for Specialized Needs

- Robust PPE designed to simplify access to the Expanded Market

- Easy to access and navigate

- Dynamic eligibility refined early in the discovery process

- Soft guideline navigation tools

- Sophisticated margin management

- Integrate with your LOS for streamlined submittal and lock

- Collaboration for faster answers when you need it

- One platform from Scenario testing to Registration

Market Trends and Insights

- Access market trends

- Gain insights to available products and borrower demand

- Market Engagement

- Streamlined access to answers

- Reduce error rates build confidence

- FREE access to your approved correspondent lenders programs

TWO-WAY CHANNEL OF COMMUNICATION

One platform to replace multiple platforms

Next generation pricing and eligibility platform for expanded expertise

Margin Management to extend access to originators

Replace manual research and emails with one integrated resource

Discovery, decisioning and transacting from a single platform

CORRESPONDENT

** Lock Management Services

AD Mortgage

Arc

Home Loans

Angel Oak

Acra Lending**

Apollo**

Bayview Loans**

Carrington Mortgage Services

Deephaven

eRESI**

First Nation Bank of America**

Flagstaff Mortgage**

LoanStream

Logan Financial

Luxury Mortgage

Maxex

NQM Funding**

Newfie

NewRez

OakTree Funding

Onslow Bay

Redwood Trust**

SG Capital Partners

Stronghold Capital

Titan Bank

Verus**

Vista Point

Western Alliance Bank**

** Lock Management Services

WHOLESALE

ACC Mortgage

AD Mortgage

AHL Funding

Angel Oak Mortgage

Arc Home Loans

Axos

Blue Point Mortgage Broadview

Clout Mortgage WMB **

Capital Alliance**

Deephaven Mortgage

Developer’s Mortgage

DG Pinnacle

Easy Street Capital

Flagstar Mortgage

Foundation Mortgage

Loan Guys

LoanLock Prime **

Loan Stream

Logan Financial

Luxury Mortgage

MC Financial

Newf

NQM Funding**

Ponce Wholesale **

Solve Mortgage **

Stronghill Capital

Visio Lending

** Lock Management Services

1.

Talk to an Expert

A LoanNEX expert will set up an enterprise account and program that fits your organization and goals.

2.

Empower Your Team

Arm your Team and Loan Officers with smarter tools and better access

3.

Grow Your Volume

Give your team access and confidence to grow your volume

I can go on for hours about how great LoanNEX is. It’s a very dynamic and smooth interface for the originator. It basically walks you through the data entry process by asking questions that eliminate the need for future inputs. And the turn times and response time are phenomenal, too.

Robert Trahan

Sprout Mortgage

LoanNEX is the best in class for non-qualified mortgages. Legacy engines are good, but LoanNEX is a NonQM-centric engine that is intuitive. The necessary attributes are embedded in the system to filter with a greater degree of accuracy to determine what loans will actually fit and which loans don’t. fit.

David Adamo

Luxury Mortgage Corp.